When mortgage rates flirt with 5.99% … and what it actually means

Is it true that interest rates dropped to 5.99%?! Yep… for a minute! Exciting? Yes! Permanent? Nope.

Wait, what?! Let me explain.

Over the past year, mortgage rates have been moving in the right direction overall, but it’s not as cut and dry as the headlines might lead you to believe. For starters, interest rates change by the hour and can change drastically overnight, so are they going to sit perfectly still at 5.99%?

You would have a better chance of getting a three-year-old to sit perfectly still through a two-hour play.

In fact, both of them have already moved. But, that’s NORMAL!

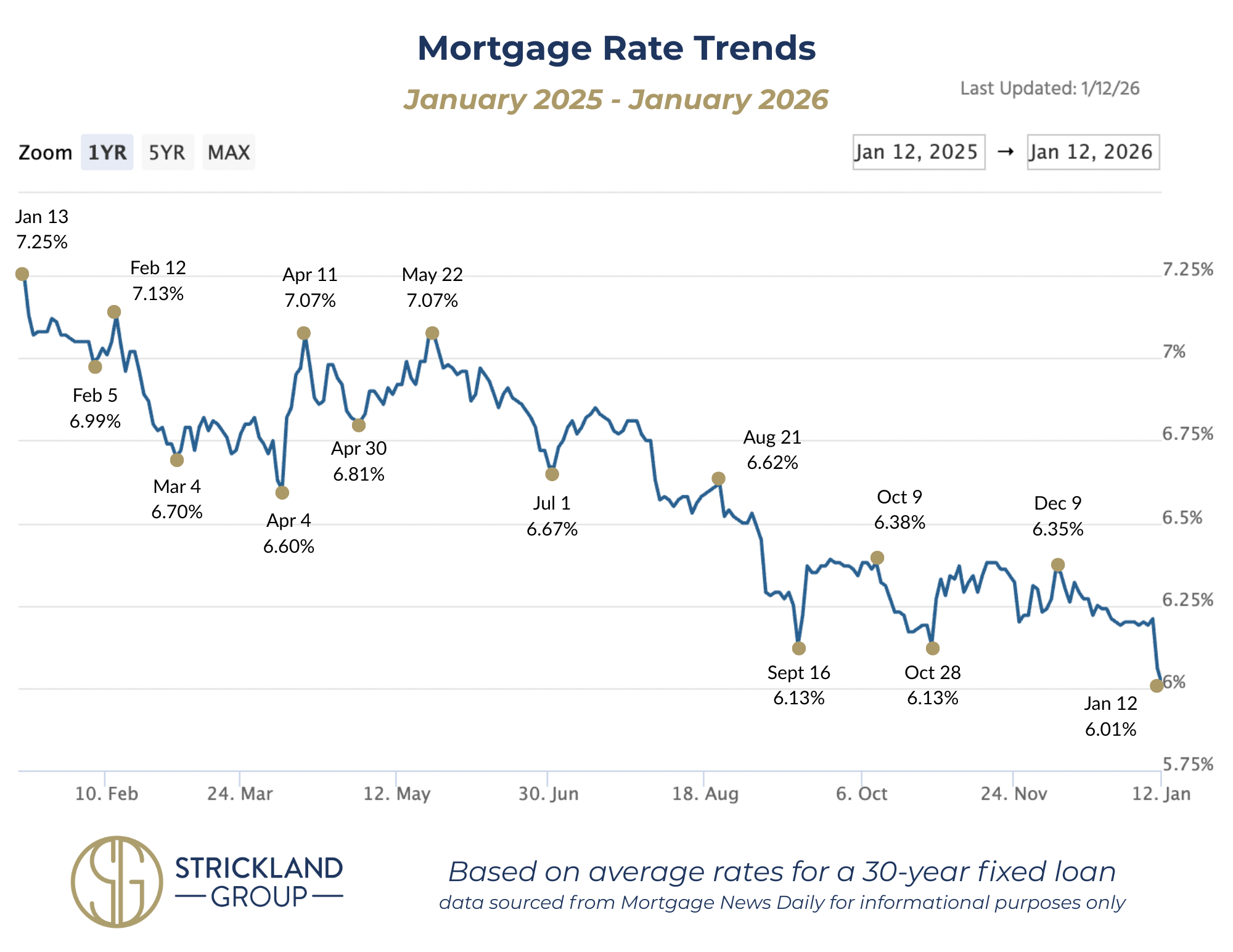

This is the first time we’ve seen rates drop below 6% in three years - if only for a moment - and it does feel promising as we look towards the year ahead. Looking at the year behind us on the chart below, you can see the overall downward trajectory of interest rates throughout 2025, as well as the fluctuations up and down.

In this particular instance, it’s important to understand why we saw that sudden drop to 5.99% over the weekend. Mortgage rates are tied to mortgage-backed securities (essentially, bundles of home loans) that investors buy and sell. When the administration instructed representatives to purchase $200 billion worth of these mortgage bonds, it dramatically increased bond demand overnight. Higher demand for mortgage bonds = lower interest rates for buyers. HOWEVER, there is not a set plan in place yet as far as when these actual purchases will take place.

While this move caused a temporary boost, it did not cause a permanent reset of the rate environment. So no, we’re not going to see a resurgence of 2 - 3% pandemic rates. Rates will continue to fluctuate due to many factors, including but not limited to global news, unemployment numbers, inflation, the bond market, tariffs, etc.

You might be thinking, "Ok, so then how do I time the market?"

When you’re buying, it’s hard to perfectly time the market because you have no control over whether the right house AND the right interest rate will surface at the same time. If you work with a strong agent + lender team, your agent can help you understand the leverage you have in crafting your offer, and the lender can help you understand the current rate conditions, as well as the best time to lock your interest rate so that you are comfortable with your monthly payment. Then, if rates drop further later on, your lender can help you refinance and capture the lowest possible rate.

Now moving on to the big picture, if interest rates continue to decrease during 2026, what happens??

What do lower interest rates mean for Buyers? When we see rates drop to a steady low number, the first buyers in the market win because it usually takes a little time for demand to go up, which is what causes home prices to go up. If you're thinking about buying in 2026, I would consider getting your ducks in a row sooner rather than later in case the right opportunity arises. Remember that interest rates and home prices will ALWAYS have an inverse relationship: lower interest rates = higher home prices; higher interest rates = lower home prices.

What do lower interest rates mean for Sellers? If rates remain steady and gradually decreasing, we will likely see buyers that have been on the fence for the last few years start to re-enter the market. That means if you have been waiting for the market to improve in order to sell, this could be your year. If your goal is to sell, I wouldn't wait for a big drop to start preparing, or else you could end up missing the boat. There's no need to rush into the market right this minute, but having an open-ended conversation to understand what to expect will save you from scrambling when the time is right.

What does all of this mean for YOU? I have no idea, but I would love the opportunity to talk through it with you! No pressure to buy, no pressure to sell, no pressure to refinance... simply up-to-date information that you can trust so that you can make the right decisions for you and your family.

Call or text me directly any time: 970-331-1352